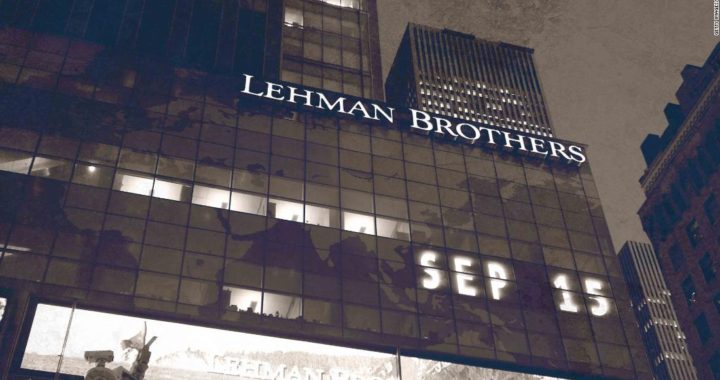

The date Lehmann Brothers filed for bankruptcy- September 15, 2008 – marked the worst of the GFC.

10 years is a long time. A decade in the markets is even longer.

New advisors and bankers who are at the beginning of their careers will have only experienced the low interest rates and liquidity that Governments around the world undertook to combat the effects of the GFC.

Have the memories of the crisis faded, has everyone simply forgotten the possibility of interest rates rising?

When the GFC happened, institutions stopped lending money and economies slowed. In turn, the deliberate liquidity injections and artificially low interest rates undertaken by central banks inspired people to begin investing again, and now are seemingly more willing than ever to take on risk.

This increased money supply has resulted in the price of assets once again rising.

A decade of low interest rates has pushed people to become braver and take on more risk. Investors aiming to make a 6% return on their money were pushed into riskier assets as yields fell. They continue to move into riskier assets to obtain the aimed for level of return, in turn pushing up the price of these assets.

You could argue this isn’t the most sensible way to approach investing, however you will find that the behaviour of people is not always necessarily rational.

Anything is possible

At the height of the GFC, I expected assets would get cheaper and that property prices would fall. Property prices did fall but not nearly as much as I had anticipated. Ten years ago, if someone told me established house values across Brisbane would be 33% higher today than they were prior to the GFC, I would have been very surprised.

The share market fell nearly 50% from the highest to lowest point over the course of a year.

I didn’t predict the GFC, but before it hit I could see that asset prices were high as well as the level of borrowings. Property yields were very low, I didn’t expect the bull market gains to continue but I didn’t expect the meltdown either. Client exposure to commercial property and highly leveraged companies was reduced in the years prior which helped a bit.

So, what can we learn 10 years on?

Risk should never take a back seat to returns, no matter how ‘easy’ the profit seems. While markets move in cycles, investors don’t seem to learn the lesson: buy good, reliable businesses with the appropriate level of debt and a durable competitive advantage and buy them when the price is right. If there is not anything suitable to buy, then hold onto your cash. Cash gives you options on future, so you are ready when a good opportunity arises.

For investment advice or if you would like a tailored financial strategy, please contact Allan Hanson of arcinvest.