“Failings of organisational culture, governance arrangements and remunerations systems, lie at the heart of much of the misconduct examined in the Commission.” – Commissioner Hayne

On February 1, 2019 the Honourable Justice Kenneth Madison Hayne AC QC, the sole commissioner of the Banking Royal Commission (also known as the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry), handed his final report to the Governor-General.

The 1133-page document includes 76 separate recommendations and refers 24 cases to regulators for potential law breaches. Court action on these cases is expected, with the report stating, “too often, financial services entities that broke the law were not properly held to account.”

Government Action

The Federal Government has stated it will implement 75 and a half recommendations, with the exception being the recommendation to introduce a blanket ban on upfront commissions for mortgage brokers. Labour have said it will implement all 76 recommendations in full.

Here are the key ways in which the changes may affect you.

Upfront fee to Mortgage Brokers

“Providing a service to customers was relegated to second place. Sales became all important…Advisers became sellers and sellers became advisers.”

- Customers will have to pay an upfront fee to mortgage brokers, which could total around $2000, if implemented.

Currently, brokers receive a commission from the bank for each successful loan application, meaning that while the customer is expecting honest and fair advice, the broker may have a financial incentive to act in a way contrary to that customer’s interests.

This recommendation flips the systems on its head by transferring the broker’s fee from the lender to the borrower, to ensure brokers act in the best interests of their customers.

- Home lending commissions to brokers to be banned over a period of 2 to 3 years, starting with trail commissions on new loans.

Superannuation Regulations

- Hawking of superannuation products (that is, the unsolicited offer or sale of such products) will be prohibited, with the report stating “Superannuation is not a product to be sold. It is a compulsory product.”

- If you have a MySuper account, you will not be deducted for advice fees.

Tighter Regulations for Financial Advisors

- If you have a financial advisor, they must be registered and disclose their lack of independence to you. You will also have to renew your fee arrangement annually with your advisor.

- A new independent watchdog will be established to oversee the existing financial regulators APRA and ASIC.

Final Thoughts

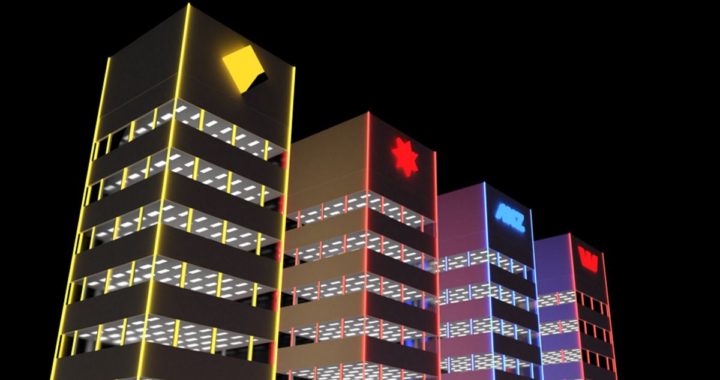

Overall, the commission’s recommendations were not as bad for the Big Four banks as expected, evidenced by their share price recovery on Tuesday.

Speculation that the financial advice divisions may be forcibly separated and that there will be changes on how bankers will be paid did not come to fruition, with no mention of these in the report.

The Banking Royal Commission has put the spotlight on banks and large financial institutions to do right by the customer – including protecting their best interests.

“Experience shows that conflicts between duty and interest can seldom be managed; self-interest will almost always trump duty…the primary responsibility for misconduct in the financial services industry lies with the entities concerned and with those who manage and control them: their boards and senior management.” – Commissioner Hayne

The full report can be viewed here.